How to Write a Check: 6 step Comprehensive Guide for 2024

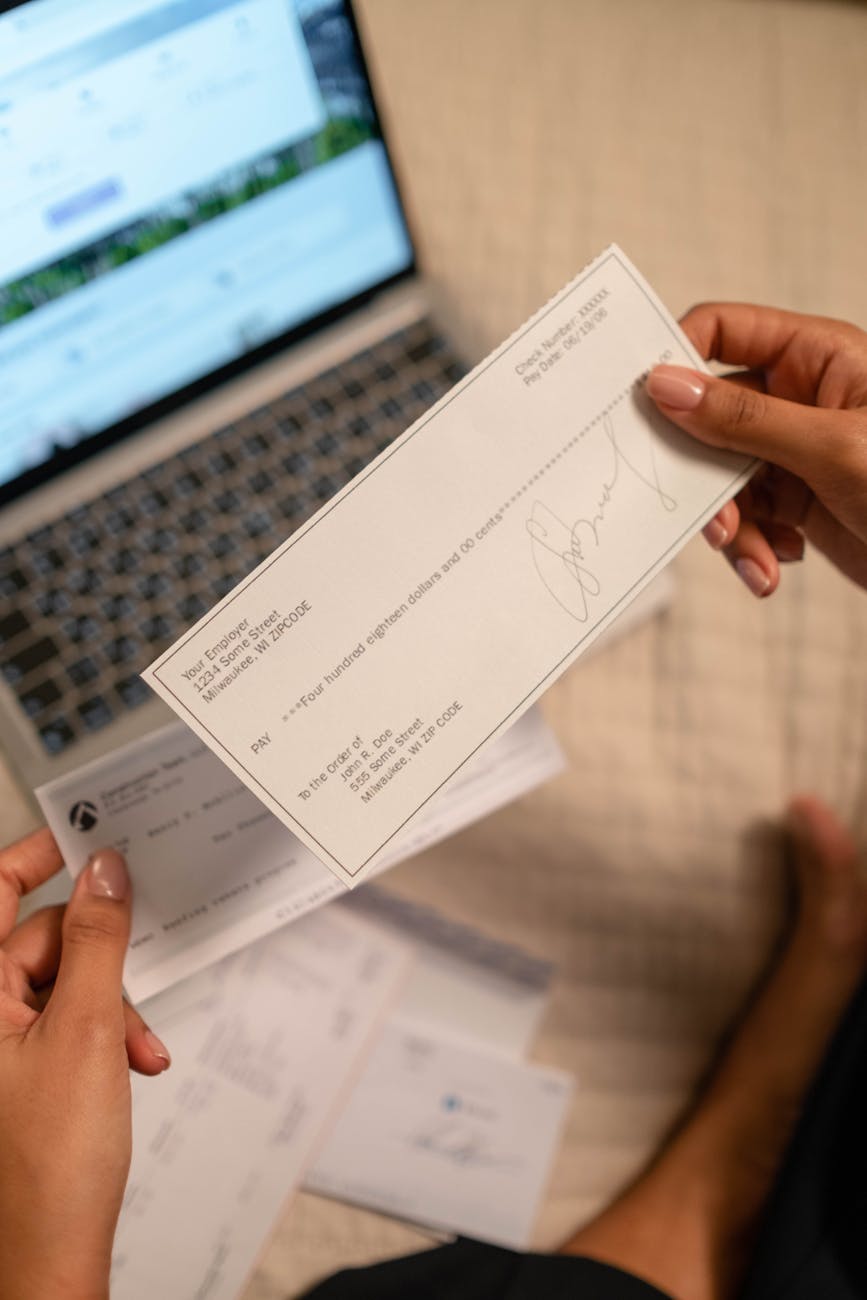

Despite the rise of digital banking and electronic payments, writing checks remains relevant in certain situations. This comprehensive guide will walk you through the steps of writing a check correctly, ensuring you can manage your finances effectively and securely.

Contents

Why Writing Checks Is Still Relevant

While many transactions are handled electronically, there are still scenarios where writing a check is preferred or required. Some landlords, small businesses, and service providers may prefer or only accept checks. Additionally, checks can be useful for gifting money, making donations, and maintaining a paper trail for certain expenses.

Step-by-Step Guide to Writing a Check

Step 1: Date the Check

The first step in writing a check is to fill in the date. The date should be written in the upper right-hand corner on the line labelled “Date.” Depending on your preference or regional standards, you can use the format MM/DD/YYYY or DD/MM/YYYY.

Step 2: Payee Line

On the line that says “Pay to the order of,” write the name of the person or organization you are paying. Ensure the name is spelled correctly to avoid any issues with cashing or depositing the check.

Step 3: Write the Amount in Numbers

In the box to the right of the payee line, write the amount of the check in numerical form. Write the amount close to the dollar sign to prevent alterations. For example, if you are paying $150.75, write “150.75.”

Step 4: Write the Amount in Words

Below the payee line, write the amount of the check in words. This step is crucial because the written amount is legally binding if there is a discrepancy. For instance, if paying $150.75, write “One hundred fifty and 75/100.”

Step 5: Memo Line (Optional)

The memo line, located in the lower left-hand corner, is optional but useful for noting the purpose of the check. For example, if paying rent for July, write “July Rent.”

Step 6: Signature Line

Sign the check on the line in the bottom right-hand corner. Your signature authorizes the bank to process the payment. Ensure your signature matches the one on file with your bank.

Additional Tips for Writing Checks

Use a Pen

Always use a pen to write checks to prevent alterations. Pencil marks can be easily erased, making your check vulnerable to fraud.

Avoid Blank Spaces

Draw a line to fill any remaining space when writing the amount in numbers and words. This prevents anyone from adding extra digits or words to increase the amount.

Record the Check

Keep a record of every check you write in your chequebook register or a digital tool. Record the date, payee, and amount to help you balance your chequebook and monitor your account.

Postdating Checks

If you want the recipient to wait until a specific date to cash the check, you can postdate it. However, some banks may process the check early. Confirm your bank’s policy on postdated checks.

Voiding a Check

If you make a mistake while writing a check, write “VOID” across the front and keep it for your records. Write a new check to ensure accuracy and security.

Use Security Features

Consider using checks with built-in security features such as watermarks, microprinting, and security holograms. These features make it more difficult for checks to be altered or counterfeited.

Common Scenarios for Writing Checks

Paying Rent

Many landlords prefer rent payments via check for easier tracking and record-keeping. Ensure you include the rental period in the memo line for clarity.

Paying Bills

Some bills, such as utilities or medical expenses, might still be paid via check. Include your account number or billing information in the memo line to ensure the payment is credited correctly.

Gifting Money

Checks are a popular way to gift money for occasions like birthdays or weddings. Make sure to fill out the check correctly to avoid any issues for the recipient.

Making Purchases

In some cases, especially for large or one-time purchases, checks can be a more secure option than carrying large amounts of cash.

Donations

Many charities accept donations via check. Include the purpose of the donation in the memo line to ensure it is allocated correctly.

Conclusion

Writing a check might seem outdated in the digital age, but it remains a valuable skill for managing personal finances and fulfilling certain payment obligations. By following the steps outlined in this guide, you can write checks confidently and accurately. Always double-check your information, keep records of your transactions, and use secure practices to protect yourself from fraud. With these tips, you’ll be well-equipped to handle any situation that requires a written check.